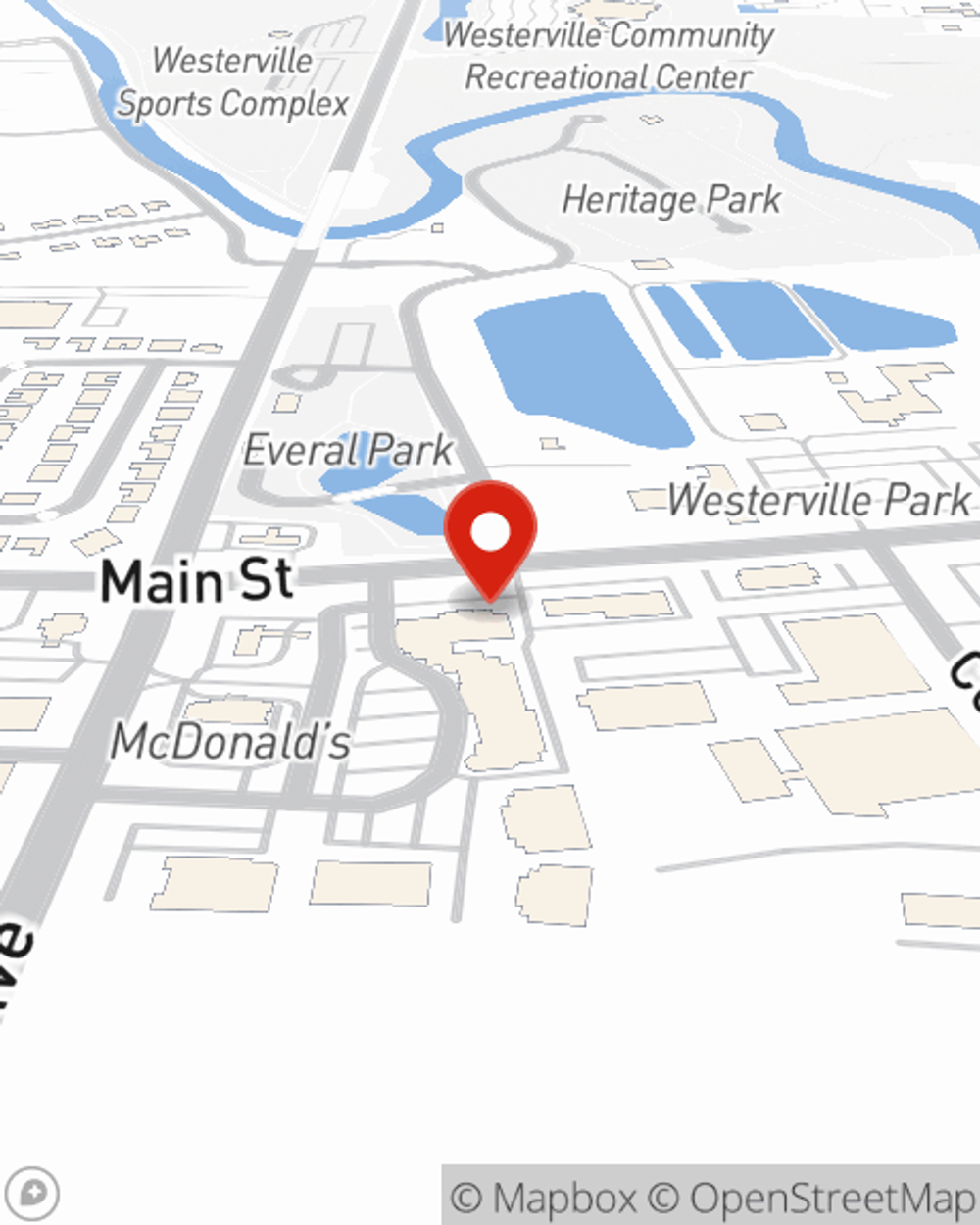

Renters Insurance in and around Westerville

Get renters insurance in Westerville

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

There’s No Place Like Home

Your rented space is home. Since that is where you kick your feet up and spend time with your loved ones, it can be a good idea to make sure you have renters insurance, even if you think you could afford to replace lost or damaged possessions. Even for stuff like your TV, children's toys, fishing rods, etc., choosing the right coverage can make sure your stuff has protection.

Get renters insurance in Westerville

Your belongings say p-lease and thank you to renters insurance

Why Renters In Westerville Choose State Farm

Renters frequently underestimate the cost of replacing their belongings. Just because you are renting a home or condo, you still own plenty of property and personal items—such as a a piece of family jewelry, laptop, couch, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why secure your belongings with renters insurance from Debbie Montgomery? You need an agent who can help you understand your coverage options and examine your needs. With dedication and efficiency, Debbie Montgomery is committed to helping you protect yourself from the unexpected.

Call or email Debbie Montgomery's office to see the advantages of State Farm's renters insurance to help keep your belongings protected.

Have More Questions About Renters Insurance?

Call Debbie at (614) 890-2886 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Debbie Montgomery

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.